Mapping your VAT accounts to the VAT return

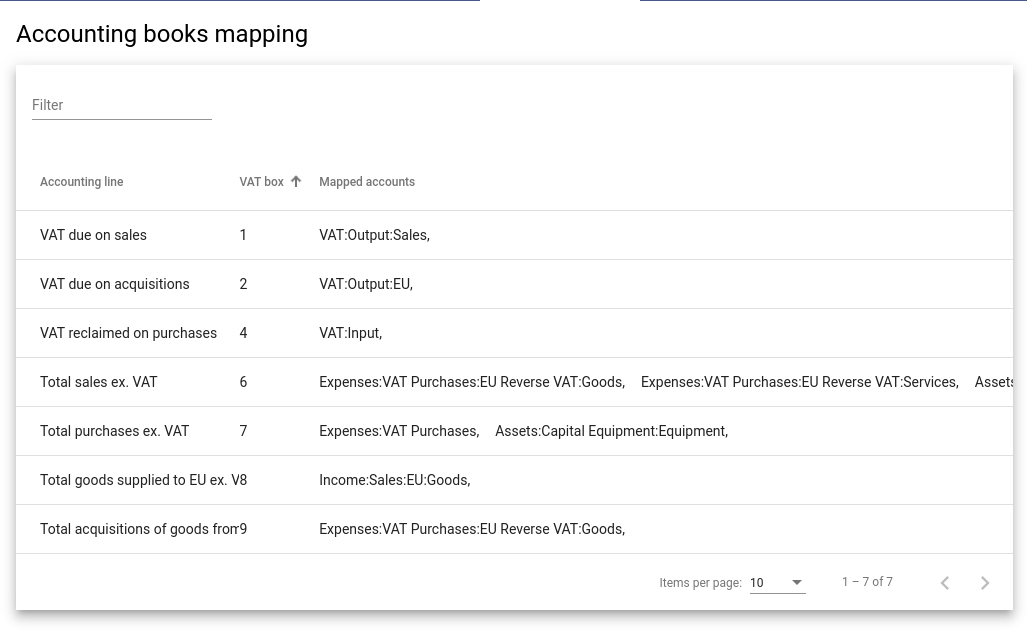

The account mappings configuration is available from the Books page. Click the link icon or select Edit mapping from the 3-dots menu. The mapping screen shows the 9 VAT boxes, along with the account lines from your accounting books.

Each of the VAT boxes is mapped to a set of accounts from your accounting books. Clicking on a line allows you to see all your account lines, marked up according to which accounts are selected for inclusion in this calculation:

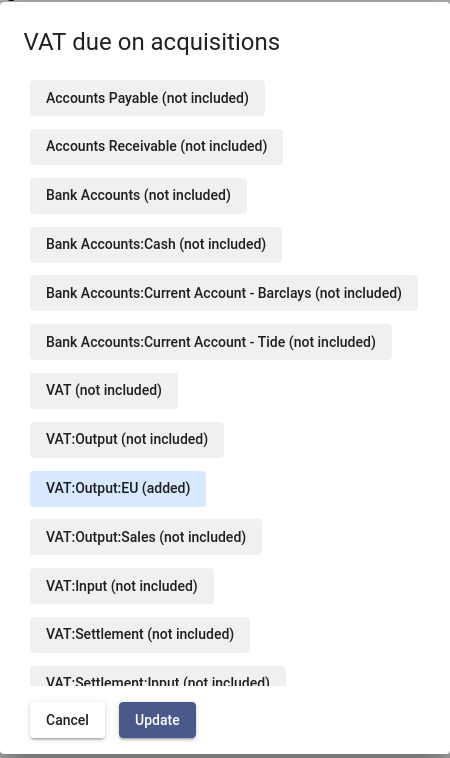

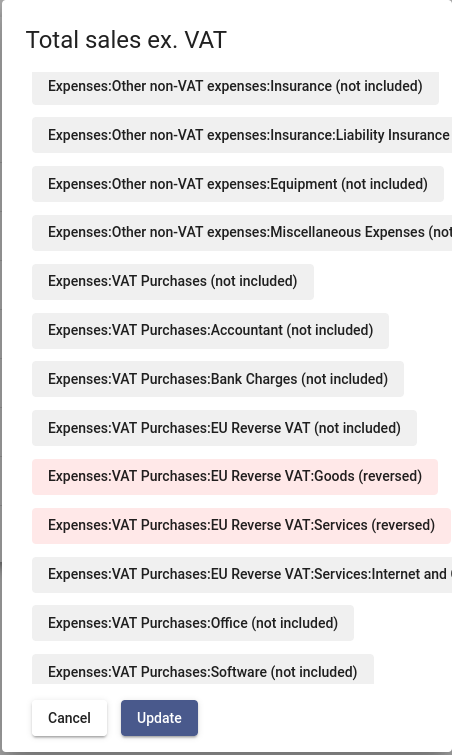

Note that each account entry can be in one of three states:

- Unselected, marked up as not included. This means the account line is not included in the calculation.

- Selected blue, marked up as added. This means the account line is added from the calculation.

- Selected red, marked up as reversed. This means the account line is deducted from the calculation.

In almost all cases, added is the correct answer. To be certain, compare the VAT Box with the type of account you are mapping.

Boxes

Added

Reversed

Box 1: Output Sales

Expense, Equity, Income

Asset, Liability

Box 2: VAT Output Acquisitions

Expense, Equity, Income

Asset, Liability

Box 4: VAT Input

Expense, Equity, Income

Asset, Liability

Box 6: Total sales VATEX

Asset, Liability

Expense, Equity, Income

Box 7: Total purchases VATEX

Asset, Liability

Expense, Equity, Income

Box 8: Total goods supplied VATEX

Asset, Liability

Expense, Equity, Income

Box 9: Total acquisisions VATEX

Asset, Liability

Expense, Equity, Income